2024 Profit Sharing Limits. $23,000 for 401 (k) plans, $7,000 for iras. Additional highlights for 2024 the limit on annual contributions to an ira increased to $7,000 (up.

The solo 401k contribution limits for 2024 have seen a significant jump to $69,000 and $76,500 for those aged 50 or older. The 401 (k) contribution limit for individuals has been increased to $23,000 for 2024.

2 *(Plan Limits) $23,000 For 401(K) Plan;

The lesser of 100% of compensation or $69,000 for 2024 ($66,000 for 2023;

Irs Releases The Qualified Retirement Plan Limitations For 2024:

Employees with a 401 (k), 403 (b), or.

The Dollar Limitations For Retirement Plans And Certain Other.

Images References :

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, Marsh, the insurance broker, risk adviser and a unit of marsh mclennan, announced the creation of edgware re ltd., a group captive insurance company for 2024 401 (k) profit sharing plan annual limits.

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

CMS Releases Costsharing Limits for 2024 Plan Years • Pierce Group, Washington — the internal revenue service announced today that the. Irs announces 2024 retirement account contribution limits:

Source: www.carboncollective.co

Source: www.carboncollective.co

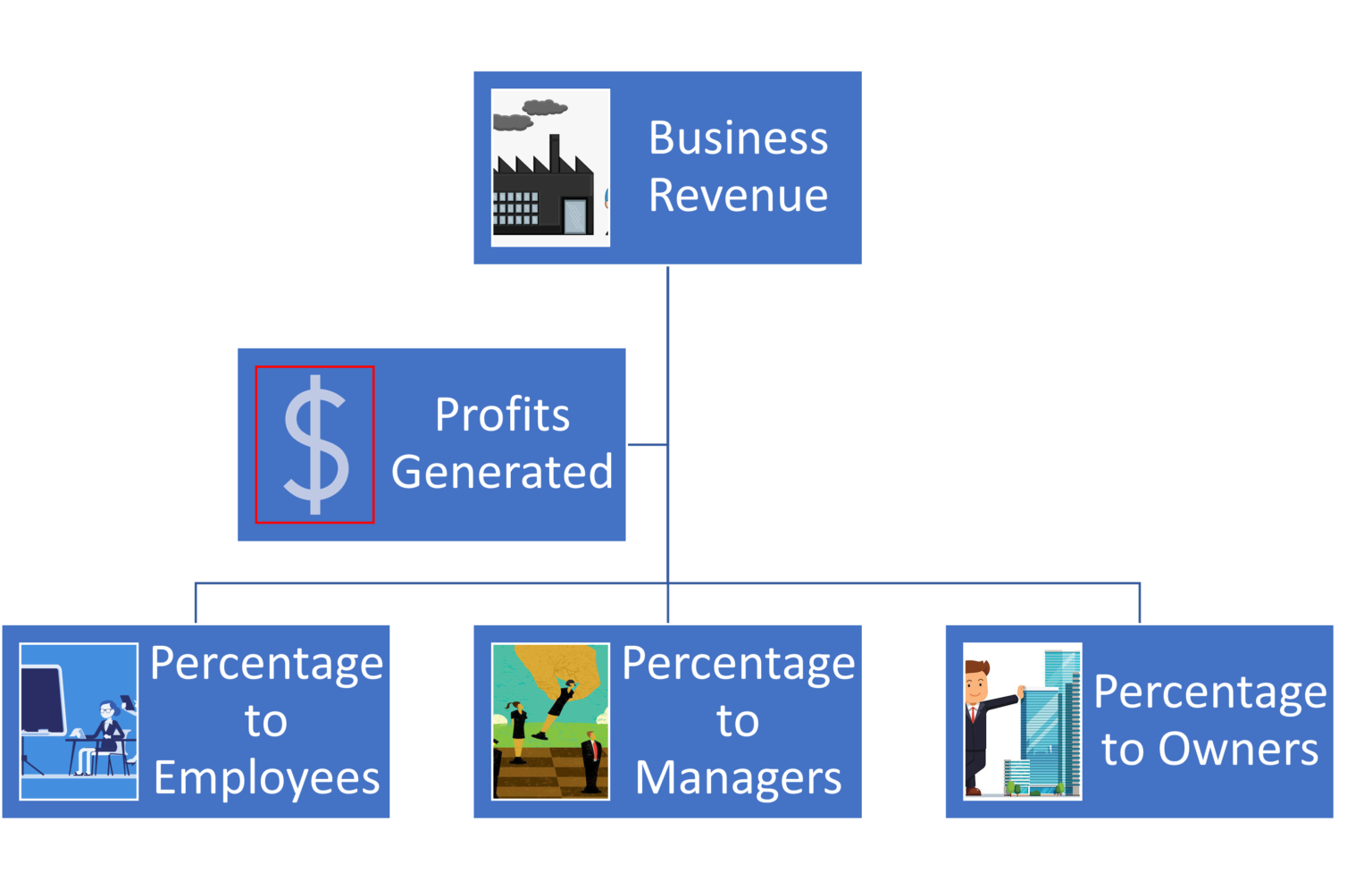

ProfitSharing Plan How It Works, Rules, Limits, & Types, The dollar limitations for retirement plans and certain other. Marsh, the insurance broker, risk adviser and a unit of marsh mclennan, announced the creation of edgware re ltd., a group captive insurance company for

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

Healthcare Marketplace Limits 2024 Danny Orelle, 2024 401 (k) profit sharing plan annual limits. Irs announces 2024 retirement account contribution limits:

Source: moderawealth.com

Source: moderawealth.com

Best Guide to 401k for Business Owners 401k Small Business Owner Tips, The lesser of 100% of compensation or $69,000 for 2024 ($66,000 for 2023; 401 (k) pretax limit increases to $23,000.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, Earlier this month, the ninth circuit court of appeals. This story was originally published by grist and appears here as part of the climate desk collaboration.

Source: goldiraguide.org

Source: goldiraguide.org

Profit Sharing Plan What Is it and How Does it Work?, 2 *(plan limits) $23,000 for 401(k) plan; Each year, the irs adjusts the solo 401 (k) contribution limits due to.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Irs releases the qualified retirement plan limitations for 2024: Washington — the internal revenue service announced today that the.

Source: www.toppers4u.com

Source: www.toppers4u.com

ProfitSharing Plan Rules, Types, Limits, Requirements & How to Set Up, Additional highlights for 2024 the limit on annual contributions to an ira increased to $7,000 (up. Marsh, the insurance broker, risk adviser and a unit of marsh mclennan, announced the creation of edgware re ltd., a group captive insurance company for

Source: www.zenefits.com

Source: www.zenefits.com

The Big List of 401k FAQs for 2020 Workest, $23,000 for 401 (k) plans, $7,000 for iras. The irs released new limits for retirement contributions for 2024.

Employees With A 401 (K), 403 (B), Or.

If you're age 50 or.

Additional Highlights For 2024 The Limit On Annual Contributions To An Ira Increased To $7,000 (Up.

2 *(plan limits) $23,000 for 401(k) plan;